Summer Real GDP Growth Highest in 4 Years

WASHINGTON (MarketWatch) -- The U.S. economy expanded at the fastest pace in four years during the third quarter, growing at a real annual rate of 4.9%, the Commerce Department reported today in making its second estimate of growth for the three-month period.

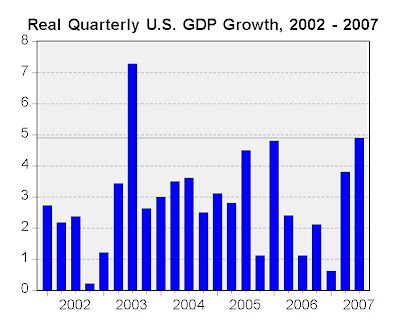

The 4.9% growth rate during the summer of 2007 was only the second time in the last 29 quarters that the economy expanded at close to a 5% rate, and it was the strongest growth rate for the economy in 4 years (see chart above).

The 4.9% growth rate during the summer of 2007 was only the second time in the last 29 quarters that the economy expanded at close to a 5% rate, and it was the strongest growth rate for the economy in 4 years (see chart above).

2 Comments:

Figure This One:

Hot GDP Data

In Cold Quarter

November 29, 2007; Page C1

A government report on economic growth today could be jarring. Despite all the angst that's gripped investors lately, the Commerce Department's report on gross domestic product, a broad measure of economic output, will show the economy expanded at a blistering pace in the third quarter.

The government's initial estimate a month ago had GDP growing at an annualized rate of 3.9% in the third quarter. Economists expect the growth rate to be revised up to 4.9%, the fastest pace in four years.

But output appears to have been boosted by a big increase in inventories, which basically means companies made more than they sold. As they work inventories down it will cut into growth. Economists polled by The Wall Street Journal in early November expected the GDP growth rate to slow to 1.6% in the current quarter, and many revised their estimates down since those forecasts.

Third-quarter GDP strength will look incongruous with profits and market movements. According to Thomson Financial, companies in the S&P 500 earned 4.4% less in the period than a year earlier. Include giant charges companies took, most notably $39 billion in tax credits General Motors wrote off, and earnings were down 28%, according to Standard & Poor's.

There are big differences between economic growth and corporate earnings. The GDP figures measure growth from one quarter to the next on an annualized basis; earnings get measured on a year-over-year basis.

More importantly, GDP measures what an economy produces. It says nothing about what you own. If your house burns down, it doesn't register much in GDP, though when you rebuild your house, it adds to output measures. The billion dollar write-offs financial firms took in the third quarter won't register in GDP either. But they certainly have with investors.

This Doomsday Scenario Over Dollar Hasn't Happened

Doomsayers have warned for years that a sharp drop in the dollar could scare away foreign investors in U.S. Treasurys and send interest rates soaring. Here's good news: Just the opposite is happening.

The dollar has fallen in value by about 4.6% against a broad swath of currencies over the past three months, according to the Federal Reserve. Over the same time, investors have flocked into government bonds, sending yields on 10-year U.S. Treasury notes to about 4%, from 4.6%.

The dollar apparently doesn't top the list of foreign investor fears. Rather than running away from government bonds, they've been running away from riskier assets like corporate debt and subprime-mortgage investments.

"A flight to quality has more than offset any decline in foreign buying [of U.S. Treasurys] as a result of the weakening dollar," says John Lonski, chief economist at Moody's Investors Service. That's been an important economic buffer because Treasury yields serve as a benchmark for many other kinds of interest rates.

Net foreign purchases of U.S. Treasurys in September totaled $26.3 billion, above 2006 average monthly purchases of $17.3 billion. But foreigners are fleeing something. Net purchases of U.S. corporate bonds were just $15.1 billion in September, down 76% from a year ago. Even good news has downsides.

--Lingling Wei

• Send comments to justin.lahart@wsj.com or lingling.wei@wsj.com

The Labor Department said new claims for unemployment aid jumped by 23,000 last week to the highest since February

"It looks like it could be lights out for the economy," said economist Chris Rupkey of Bank of Tokyo-Mitsubishi UFJ in New York, referring to the rise in claims. "This is exactly what it looks like when we are going into recession."

http://today.reuters.com/news/articleinvesting.aspx?type=bondsNews&storyID=2007-11-29T141957Z_01_N29354577_RTRIDST_0_USA-ECONOMY-WRAPUP-1.XML&pageNumber=0&imageid=&cap=&sz=13&WTModLoc=InvArt-C1-ArticlePage2

Post a Comment

<< Home